The Math Behind the Functions#

Investment tax-net value#

In general, an investment’s tax-net value can be calculated by

Where:

\(V_0\) is the initial value of the investment.

\(V_n\) is the final gross value of the investment.

\(n\) is the number of compounding periods (generally years).

\(tr\) is the tax rate applicable to that investment.

This can be simplified to

This applies for both the \(PPR\) and its \(Underlying \; Assets\). The only difference is the \(tr\) applied.

Investment gross value and PPR costs#

The gross final values, \(V_n\), for the PPR and its Underlying Assets (UA) can be calculated by

and

Where:

\(UA_n\) is the final gross value of an investment in the PPR’s UA.

\(PPR_n\) is the final gross value of an investment in a PPR, not considering any tax credit.

\(r\) is the UA’s cumulative annual growth rate (CAGR).

\(cr_{PPR}\) is the total PPR-specific cost incurred by the investor every year, expressed as a percentage of the year’s investment value. It includes the management commission, banking fees, audits, and other costs of running the fund.

PPR Tax Benefits#

Investment in a PPR generates a tax credit in the following year of \(20\%\) of the amount investment, until that amount reaches a certain limit depending on the investor’s age.

Where:

\(TC_0\) is the tax credit.

\(tcp_{PPR}\) is the percentage of \(V_0\) returned as tax credit. We can consider it as always either \(0\) or \(20\%\), because even an investment that is not fully considered for the tax credit can be split between the portion that is considered in \(20\%\) and the portion that does not generate any tax credit.

If we assume that \(TC\) is invested in the PPR, we have

Where:

\(TC_n\) is the final gross value of the investment of the tax credit in a PPR.

\(TC_0\) is the initial value of the tax credit.

PPR tax-net value#

Given the expressions above, we can get the tax-net value of an investment in a PPR as

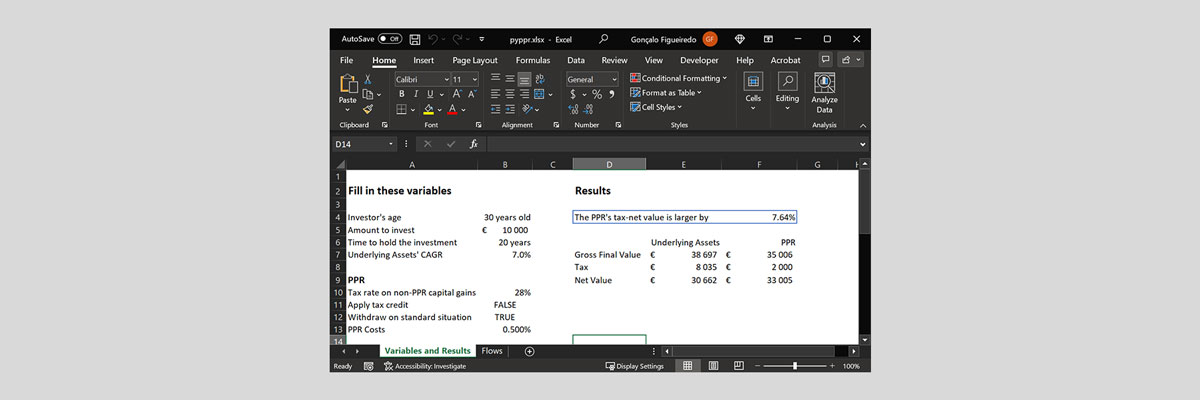

Supporting Excel#

Download the Excel we used to confirm the math above.